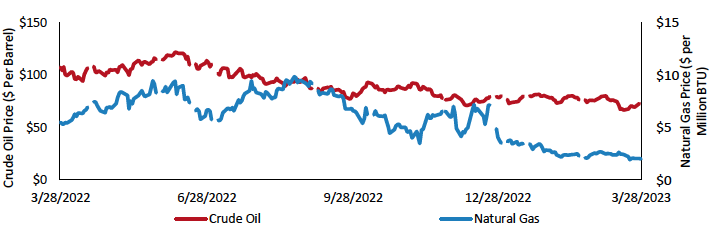

Energy Prices

Energy markets have mostly recovered from the shock caused by the conflict in Ukraine. The US government dipped into its reserves over the summer to offset the loss of Russian energy, while other countries stepped up oil and gas production to take advantage of high prices. This influx of oil and gas helped to stabilize global markets. These markets are historically volatile, however, so it is prudent to plan for potential risks over the coming months.

China, which consumes roughly 15% of the world’s oil and 7% of its natural gas, lifted its COVID-19 restrictions in December and its consumers are spending again. Energy prices spiked after the US lifted most of its restrictions in 2021, and China has over four times as many consumers. A similar surge in demand from China can similarly upend the energy market. Further complicating things are possible production cuts in Russia – one of China’s leading suppliers. Chinese consumers will look elsewhere for crude oil, and this will push prices up.

European countries stockpiled natural gas over the summer to heat their homes during a winter that turned out to be quite mild. This left an excess of natural gas that caused prices to fall below $3.00 per million British Thermal Units. We expect prices to stay flat through the end of the year, but it is worth keeping an eye on the market and planning accordingly.

Energy markets are famously unstable – so much so that government agencies avoid them when studying inflation and consumer spending. The main risks over the coming year are extreme weather and production cuts. Summer heatwaves could spur demand for natural gas and cause price to rise. Meanwhile, petroleum-exporting countries like Russia or Saudi Arabia could cut production and force prices to rise to take advantage of Chinese demand.

To take advantage of the current market, consider purchasing diesel and gasoline for generators before summer ends. Higher energy costs could make plastics and insulation materials, which are made from oil and gas products, more expensive as well. The timing of purchases related to natural gas is not as important, as prices are expected to stay flat.

Source: Federal Reserve Bank of St. Louis

Copper Prices

Copper prices rose strongly from November 2022 through the end of January 2023 before paring those gains in February and March. Despite the recent selloff, copper prices remain elevated, both compared with historic norms as well as compared with other base metals. As the only one of the big six London Metal Exchange (LME) metals that is still trading above its 100-day moving average, copper’s market is broadly expected to move into surplus in 2023, driven by a combination of greenfield and brownfield capacity expansions as well as higher capacity utilization rates at existing mines.

In addition, while the faster-than-expected lifting of some zero-COVID restrictions in mainland China does provide some additional support to the mainland Chinese demand outlook for 2023, slowing new export orders and weakness in the property sector and consumer confidence remain a headwind. Meanwhile, consumption in Europe and North America is forecast to contract in 2023 as both regions move into a mild recession, partially offsetting growth in Asia.

We expect copper prices to fall as its market moves into surplus this year. The chart below shows historical trends for copper in the construction industry, measured in percent change from the previous month. We continue to urge caution as forecasts and markets continue to change almost daily.

Source: Federal Reserve Bank of St. Louis, Monthly, Not Seasonally Adjusted

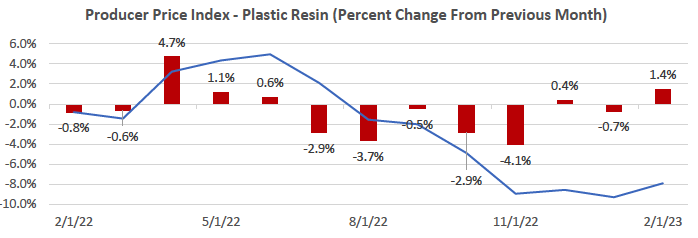

PVC Prices

Demand levels for PVC have slowed significantly, putting downward pressure on prices and this will continue in the near term. Global PVC demand is declining as the construction sector, specifically the US residential housing market, faces severe headwinds, which will send prices lower in the US through 2023. Central banks are aggressively tightening monetary policy, which will continue to reduce housing market activity and subsequently PVC demand in 2023.

PVC prices will edge upward in the 2nd quarter of 2023 because of a seasonal demand boost. The 2nd quarter is annual restocking season, and this will be enough to pull prices higher. That said, underlying demand remains weak. This is because the construction sector, specifically the residential housing market, faces severe headwinds. Total demand for PVC in North America up to January 2023 was down 17% compared with the same period in 2022.

Global prices will ease through 2023 because of slowing demand, but higher energy costs remain an upside risk to the outlook. Prices in Europe and North America peaked in the 2nd quarter of 2022, having on average doubled since the post-pandemic lows in 2020. Prices in Northeast Asia have been declining since the start of 2022 as demand from mainland China weakened sooner than in other regions. Overall, we advise buying as needed since the price correction is now firmly under way and buyers can take advantage of this.

The chart below shows historical trends for PVC in the construction industry, measured in percent change from the previous month. We continue to urge caution as forecasts and markets continue to change almost daily.

Source: Federal Reserve Bank of St. Louis, Monthly, Not Seasonally Adjusted