Drew Lantz and Xinyao Wang

February 4, 2022

We believe rising input costs are currently driving up prices for both cement and concrete. Rising energy prices and seasonal factors could explain the price increase in the first half of 2022, before price escalation slows as energy costs recede.

Cement price has a YoY change of 3.7% in 2021 and is expected to be 4.3% in 2022, which is a marked acceleration from 2020, when prices rose just 1.1%. Growing input costs including energy prices, elevated transportation costs, and a tightened labor market are the key factors impacting price increases. Ready-mix prices have a YoY change of 3.2% in 2021 and are expected to be 5.7% in 2022, with prices increasing 2.1% and 2.4% respectively in the first and second quarters of 2022. Within the US, prices are expected to have the sharpest increases in the South and West regions, since those markets have the tightest market fundamentals. This is consistent with hydraulic and blended cement shipments and clinker production data, which are both down in the first nine months of 2021 relative to 2020 in Texas, Colorado, and Wyoming. Cemex even noted abnormally heavy rains in Texas as impacting local market fundamentals in its third-quarter 2021 earnings report.

Looking ahead, price increases for cement and concrete are typically pushed through by manufacturers in January. Besides such seasonal price increases, accelerated energy costs will permeate the supply chain and be passed along to consumers, resulting in strong price escalation over the first half of 2022.

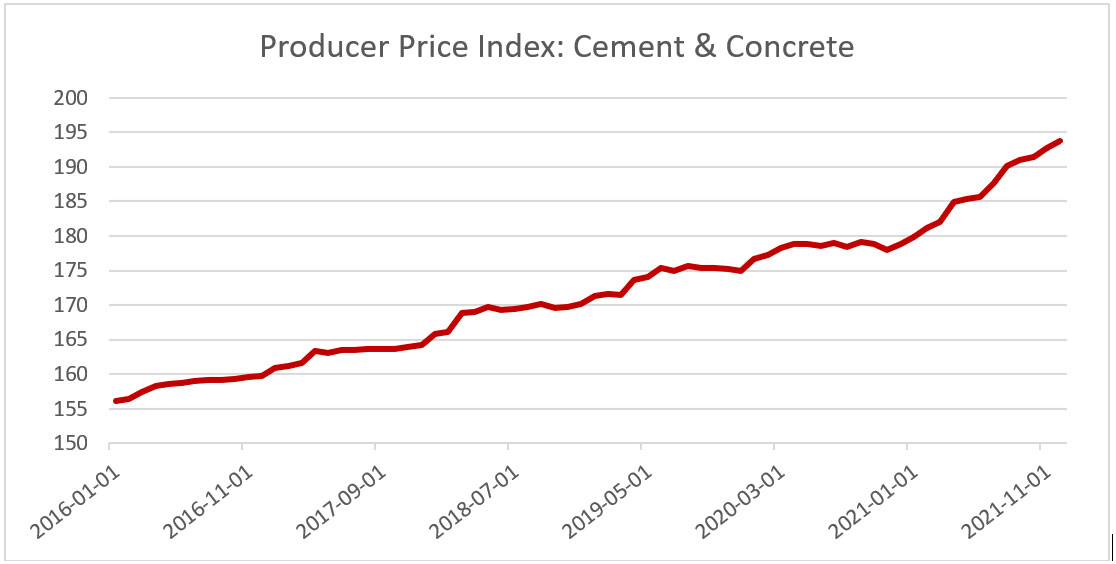

The chart below shows historical and current price trends for Cement and Concrete in the construction industry.