Lumber Prices

The overall outlook for the lumber market has not changed significantly since prices began falling last Summer. Slowing demand from the residential sector has resulted in fewer orders, while a mild winter has allowed sawmills to operate longer than usual. This has let producers fill their backlogs and greatly reduced volatility in the market. Overall, however, many in the market are keeping their powder dry and awaiting changes in economic conditions. Prices have stayed mostly flat as a result. If possible, only make necessary purchases until conditions change.

The residential market is by far the largest source of demand for lumber. As interest rates rise, borrowing money for a new development becomes comparatively more expensive, which leads to a decline in demand. This translates into less spending and more saving – a key goal of policymakers who worry that the economy has been running too hot for too long. A key side effect, however, is fewer pipeline projects and less lumber being needed. Forecasts for construction volume in 2023 have been consequently revised downwards.

Mills continued to operate throughout the fall to fill backlogs and replenish stockpiles. This has returned output and prices to roughly their pre-pandemic levels. It should also improve lead times going forward. Producers have instead shifted their efforts to ensuring that output does not exceed demand and that operating their mills is still profitable. This means mothballing some facilities and keeping others operating at less than full capacity. Fortunately, it also means that the days of shortages and dramatic price swings are behind us.

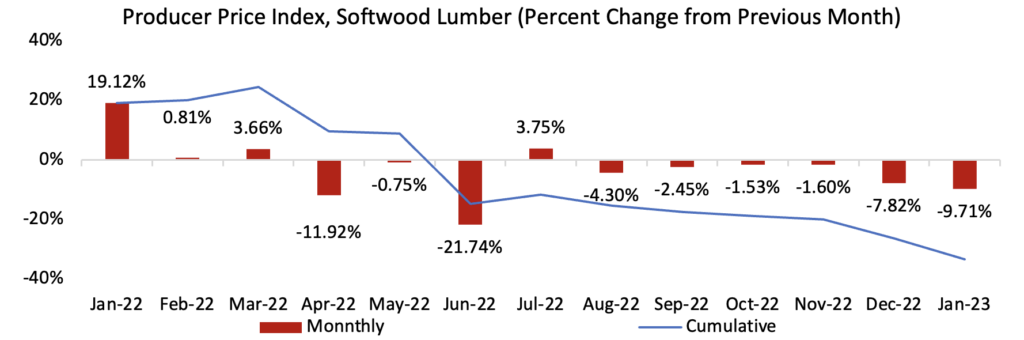

Still, there are a few risks. Different economic indicators continue to forecast different things, and this has made many businesses reluctant to expand. This in turn has resulted in fewer construction projects in the pipeline, lest the market crash and they find themselves overextended. Heavy snowfall in the Pacific Northwest can damage rail infrastructure and make transportation more difficult. The chart below shows historical trends for lumber in the construction industry compared to the previous month. We continue to urge caution, however, as forecasts and markets change almost daily.

Source: Federal Reserve Bank of St. Louis

Steel Prices

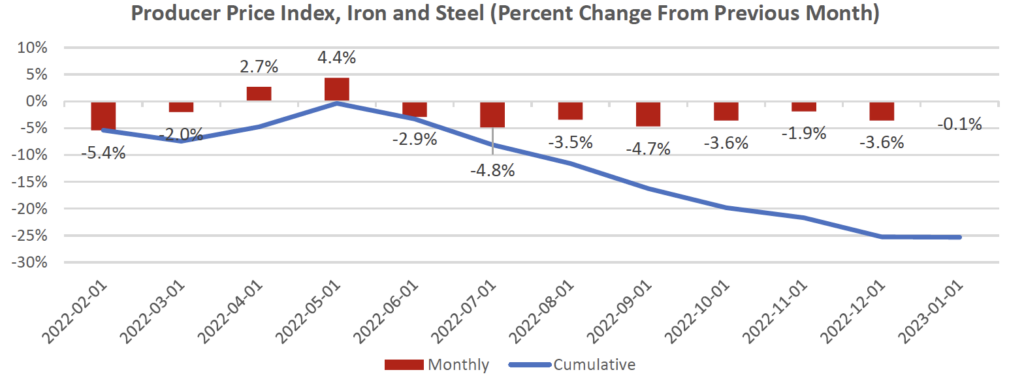

While the steel industry does have some potential risks for 2023, the overall trends and predictions indicate that the sector should maintain its strength coming into the new year. Construction steel prices have been falling since mid-2022, albeit at a reduced pace compared with flat products. We expect the decreases to continue in the United States, but the bottom has been reached in Europe while Asia is expected to bounce back slightly in 2023.

Global energy costs will continue to pose a significant risk to pricing in the first quarter of 2023, particularly for Europe, as most of the economies were highly reliant on natural gas from Russia. A cold first quarter of 2023 will mean cuts for steel mills and manufacturers to ensure heating for residential customers. European buyers should have explicit contingency plans for a delivery failure.

Prices in the United States will keep going down as raw material prices have weakened. The price spreads between scrap and medium sections have been extremely high in 2022, more than $700/metric ton compared with pre-pandemic levels but the gap is slowly closing. However, supply chain bottlenecks remain. The medium sections’ price floors in the US will be higher compared with pre-pandemic levels, with prices expected to average $964/metric ton, higher than pre-pandemic peaks of 2012 (around $900/metric ton) and 2018 (over $940/metric ton). The bipartisan infrastructure act passed before, as well as strained long product capacity, will provide support for prices this year and in 2024.

Source: Federal Reserve Bank of St. Louis

Cement & Concrete Prices

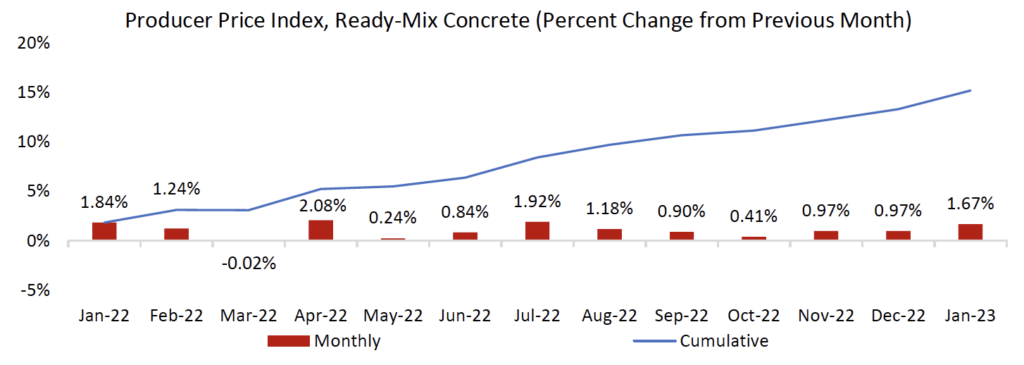

Concrete and cement prices have fallen into a steady rhythm that began early in 2021. They increase by roughly 1% each month – a little more in the summer, a little less in the winter. Things are expected to moderate over 2023, although high energy costs, supply and demand mismatches, and recent bank failures pose unique challenges. We recommend buying as needed for the next few months, particularly for projects in the West and South. It is still too early to see how things will play out, so it is best to await new developments.

Construction projects rely on access to credit – people don’t have billions of dollars for a new skyscraper just lying around – so banking failures pose unique threats to the industry. Some markets, like Chicago, still haven’t recovered from the shock of the 2008 financial crisis. The failures of Silicon Valley and Signature Banks have made other banks hesitant to lend out money for new projects lest they be unable to repay their depositors. This could mean less demand for new projects and consequently lower prices for concrete. It is still too early to be sure, but regulators have acted swiftly and decisively to contain the damage. We still have a long way to go before another Great Recession.

The Biden administration has already set aside billions of dollars for infrastructure spending – everything from highways to bridges to ferry terminals to high-speed rail. These kinds of projects use concrete in greater proportion than other sectors, and producers have been working hard to replenish stockpiles and train new workers in anticipation. In the meantime, consumers in the South and West have had to import concrete from abroad. Many of these projects will benefit from federal spending and will be insulated from the banking industry’s woes. This should keep prices steady even if demand declines. The chart below shows historical trends for cement and concrete in the construction industry compared to the previous month. We continue to urge caution, however, as forecasts and markets change almost daily.

Source: Federal Reserve Bank of St. Louis