By Jessica Busch

As we forge ahead into 2024, the construction industry finds itself at a critical juncture, grappling with a myriad of significant challenges and some untapped opportunities. The landscape painted by the data from 2023 offers a mixed picture that needs analysis, with modest growth in some sectors, but major declines in others.

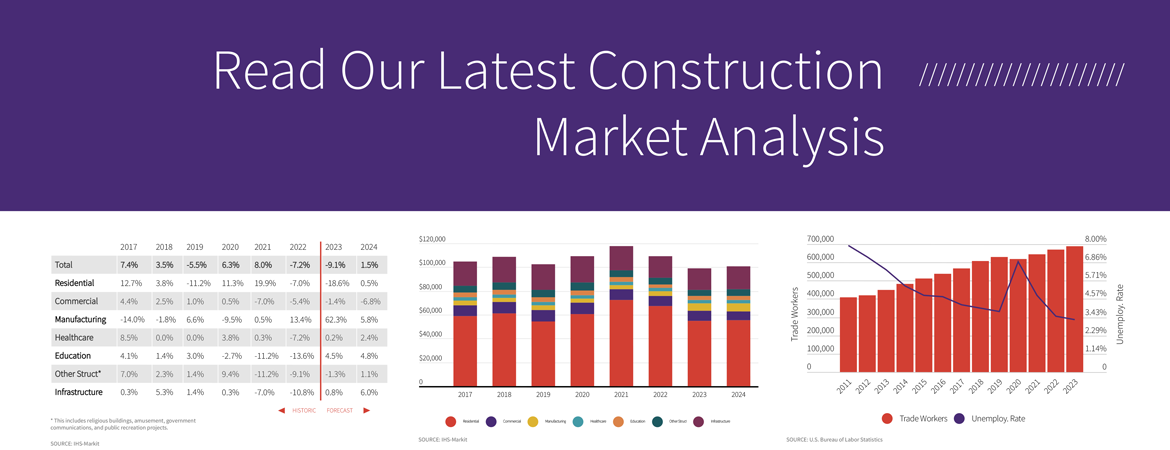

One of the key takeaways from 2023 is the apparent dichotomy between nominal growth and real economic activity. While the construction industry managed to eke out a reserved 1% growth, it was largely driven by inflation rather than genuine expansion in volume. When inflation is factored out, spending actually experienced a slight decline of more than 1%. This discrepancy underscores the importance of delving beyond surface-level statistics to truly understand the underlying dynamics at play.

Labor challenges continue to persist as a significant hurdle across the industry. The exodus of workers from the construction sector in 2020 continues to reverberate, pushing labor costs upward and worsening shortages. Despite efforts to attract new talent, the pace of recruitment has failed to keep up with demand, leading to labor constraints that impede project timelines and escalate costs.

Additionally, the supply chain disruptions witnessed in recent times have further compounded the industry’s woes. Volatility in material prices, coupled with logistical challenges, has disrupted project workflows and strained bottom lines. However, there are indications that the runaway escalation in material costs is gradually returning to more manageable levels, offering a glimmer of hope for firms seeking stability in their operations.

Amidst these challenges, there are pockets of resilience and growth that merit attention. The influx of federal funds into critical sectors such as manufacturing, transportation, and clean energy infrastructure presents lucrative opportunities for construction firms willing to capitalize on them. Initiatives like the CHIPS Act and the IIJA are poised to inject billions of dollars into high-value projects, providing a much-needed stimulus to an industry grappling with uncertainty.

Another glimmer of hope to keep focused on is the increased pre-feasibility activity in certain markets, indicating a cautious optimism among investors and developers. While the overall pace of construction may vary across regions, the underlying fundamentals driving pre-feasibility studies suggest a hidden demand waiting for conditions to stabilize.

Overall, while the construction industry continues to navigate choppy waters marked by labor challenges and supply chain disruptions, there are many reasons for cautious optimism. Despite some sectors experiencing slowdowns, the uptick in pre-feasibility activity is signaling the industry’s underlying strength and resilience, while the gradual normalization of runaway escalation in material costs offers hope for firms seeking stability in an uncertain environment.

It will be imperative for industry stakeholders to remain vigilant, adaptable, and forward-thinking in 2024 to capitalize on emerging opportunities and navigate the complexities of a rapidly evolving landscape.