January 6, 2023

By Xinyao Wang, Insights Team

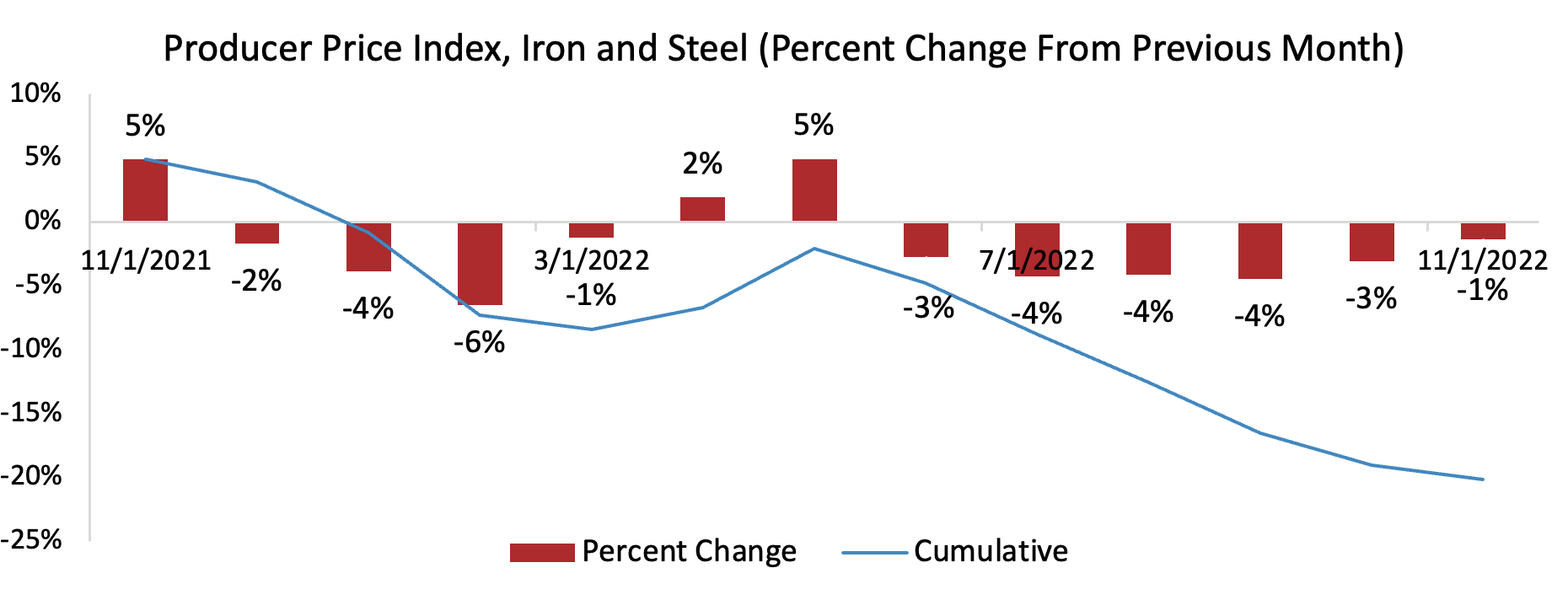

Steel prices continue to register their lowest values since May 2021. Spot prices going into 2023 are almost 20% less than those going into 2022. This slide is primarily due to what people in finance call “mean reversion”: as time goes on, prices return to their average. Steel prices had been unsustainably high for almost two years, and this is a return to form rather than a sign of weakness. We expect them to continue to decline and recommend waiting until the spring before making major purchases.

Steel production has steadily grown over the last few years as producers struggled to keep up with residential demand. Mills continue to operate even as demand has tapered off, causing prices to fall. When Russia invaded Ukraine in late February, the subsequent spike in energy costs caused a rebound in pricing. By the summer, however, it was clear that this was not a permanent trend and prices resumed their slide. Experts disagree about exactly how low they will go, but all agree that they will continue to drop through the first quarter of 2023.

Natural gas reserves are beginning to be tapped to keep houses warm in the winter – potentially leaving less available to run steel furnaces. Sanctions on Russia – one of the EU’s largest steel importers – have so far ignored metals but are being reexamined as the war goes on. If the 400 million tons of steel that Russia exports annually are suddenly cut out of the market, it would cause consumers to scramble to fill orders and prices would rise again.

Mean reversion is taking over across the world economy and across markets, causing declines in price for many commodities. There are still risks – primarily the surge in COVID cases in China forcing factories to close – but the outlook continues to improve. Steel costs will likely continue to drop as the market corrects for the past two years. The chart below shows historical trends for steel in the construction industry, measured in percent change from the previous month. We continue to urge caution, however, as forecasts and markets continue to change almost daily.