By Drew Lantz, Insights Team

An old joke among economists says that the four most dangerous words in the English language are, “This time is different.” But the conflict between Russia and Ukraine is the first of its kind, where troop movements are broadcast on social media and sanctions are deployed on such a scale. This time really is different. The effect of sanctions has been amplified by the number of private companies that have divested from Russia without being asked. No one is sure what will happen when the sanctions are lifted, and this uncertainty is fueling price increases for key commodities.

Fortunately for the construction industry, these increases should be limited to commodities that use oil and gas as a primary input; the largest increases should be for asphalt and PVC resin. Russia is not a significant producer of other commodities: lumber mostly comes from Canada, copper mostly comes from South America, and steel is mostly produced domestically. These will probably see modest increases in price as well, but nothing like what we’ve seen with oil and gas.

In a bid to avoid exactly the kind of economic shocks that we’re seeing, the first wave of sanctions conspicuously left petrochemical exports alone. As the war has gone on, people in the West have begun to feel that punishing Russia was worth the cost at the pump. Sanctions are predicted to cut Western countries’ growth by about 0.2%, but cut Russian growth by about 10%. Russia is now effectively fighting two wars: a military conflict in Ukraine and an economic conflict with the West.

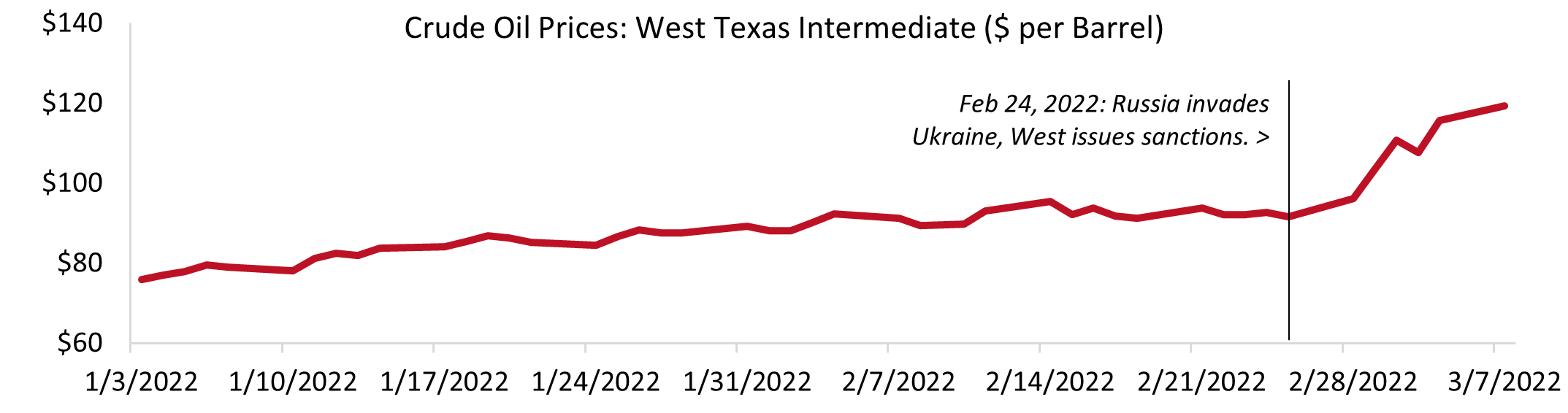

Sanctions on Russia effectively reduced the available supply of crude oil by about 11%. This alone is enough to raise prices, but the two or threefold increase is primarily due to expectations. Most consumers cannot change how much they drive in the short term, and therefore buy roughly the same amount of gas regardless of price. People worried about inflation and escalating sanctions decide to buy now rather than wait for prices to rise. This creates more demand, which increases prices, which creates more demand, and so on.

Experts are unsure what will happen when sanctions are lifted. They will probably last as long as the conflict does, and even longer if Russia annexes parts of Ukraine. It is less clear, however, what will happen with the companies that have voluntarily let go of their Russian assets. Even if these are nationalized, the loss of foreign experts will hamper production for several years. Prices will stabilize when the conflict ends. This could be anywhere from next week to years from now. The question, therefore, is whether they will decline after — and if so by how much. The answer, unfortunately, depends on Russia.