Because the vast majority of zinc comes from a handful of countries, the market can be quite volatile. Things like a presidential election in Peru, a push for green energy in China, or a shortage of shipping containers in Australia can destabilize prices. After being thrown into disarray because of the pandemic, increased mining activity is expected to cause zinc prices to recover.

Zinc production grew by almost 10% in the first few months of 2021, and is beginning to run into bottlenecks in refining and logistics. Refineries must accommodate this increase in the short term, causing some to become overburdened. Furthermore, zinc that is ready to be used must be shipped from refineries in Peru and China to its destination, adding further delays and cost increases.

Although supply is somewhat constrained, demand is subdued as well. Mainland China consumes roughly half of all zinc produced each year. To encourage factories to switch to green energy, the Chinese government has been cutting coal access to polluters. This has kept Chinese industrial activity relatively stagnant, and freed up more zinc for export. Combined with the increase in mining activity, this is expected to create a surplus of zinc for a few years. This surplus is expected to insulate prices from market volatility, and keep them stable in the short term.

Logistics issues have led to regional price differences, but these are expected to be temporary. Political reforms in Peru and Chile – which together account for about 15% of zinc production – have also raised concerns and reduced foreign investment there. Combined with stricter environmental regulations in China, these can lead the market to become more prone to price changes in the long term.

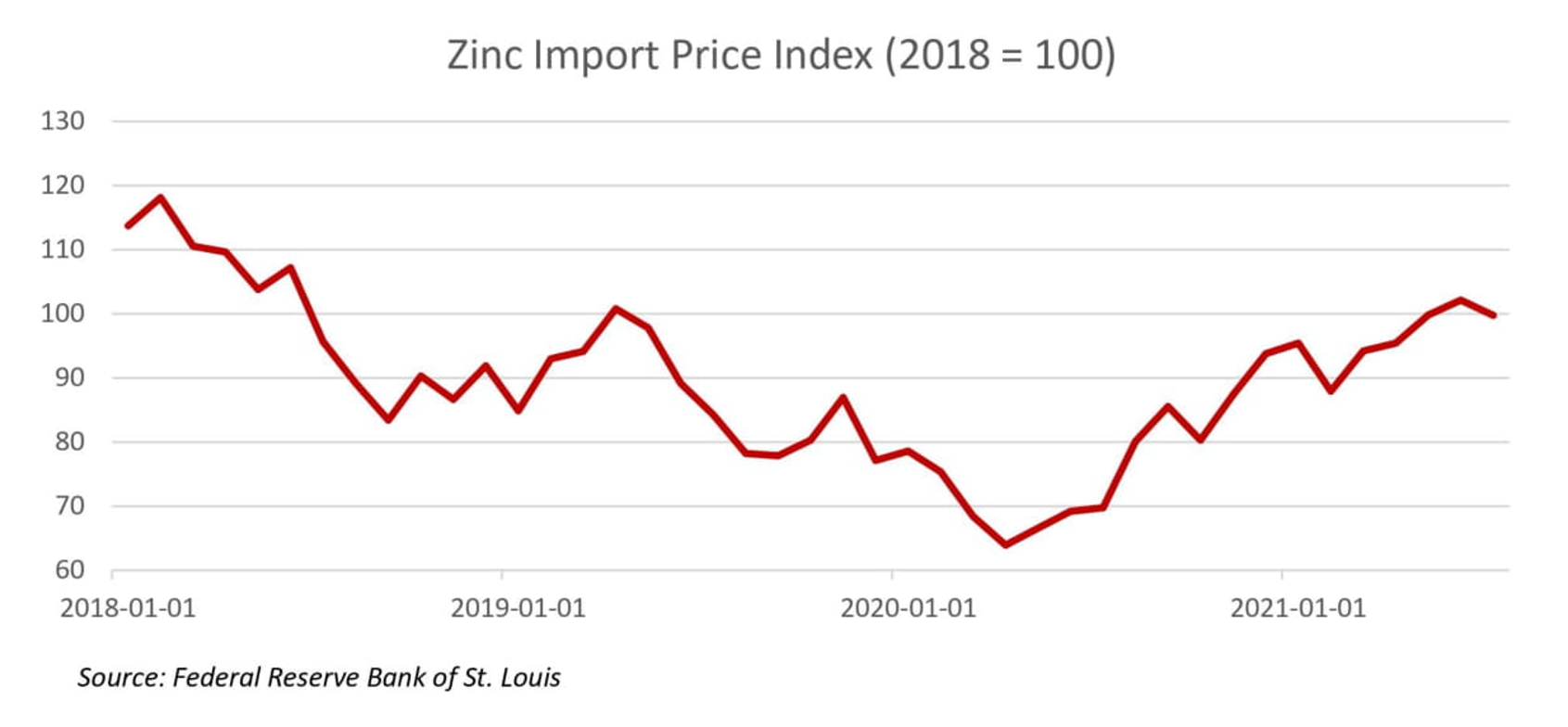

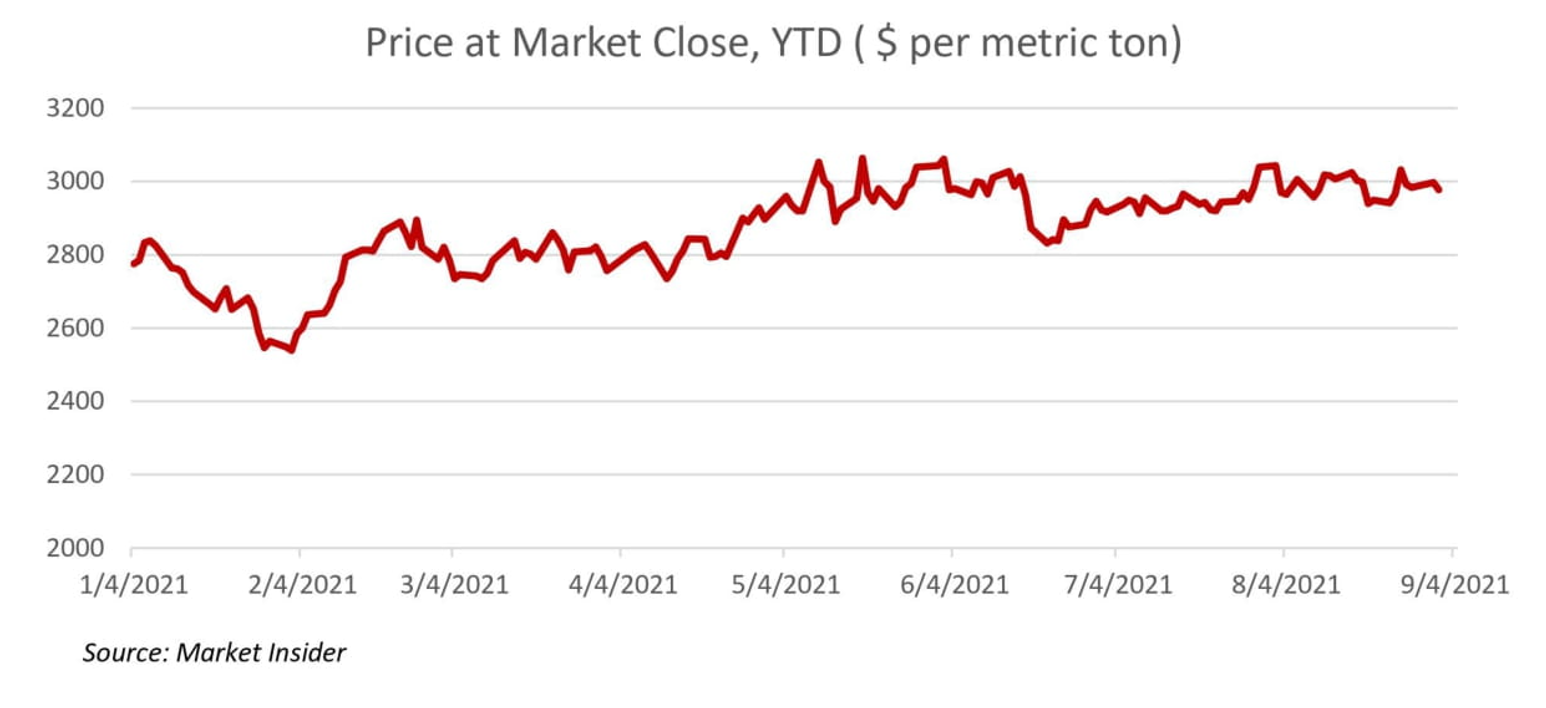

Below are charts showing historical trends for zinc in the construction industry. These are based on current trends and are subject to change. Markets are still volatile because of the pandemic and consequential uncertainty, and while conditions are improving as recovery continues, they remain unstable.