By Xinyao Wang, Insights Team

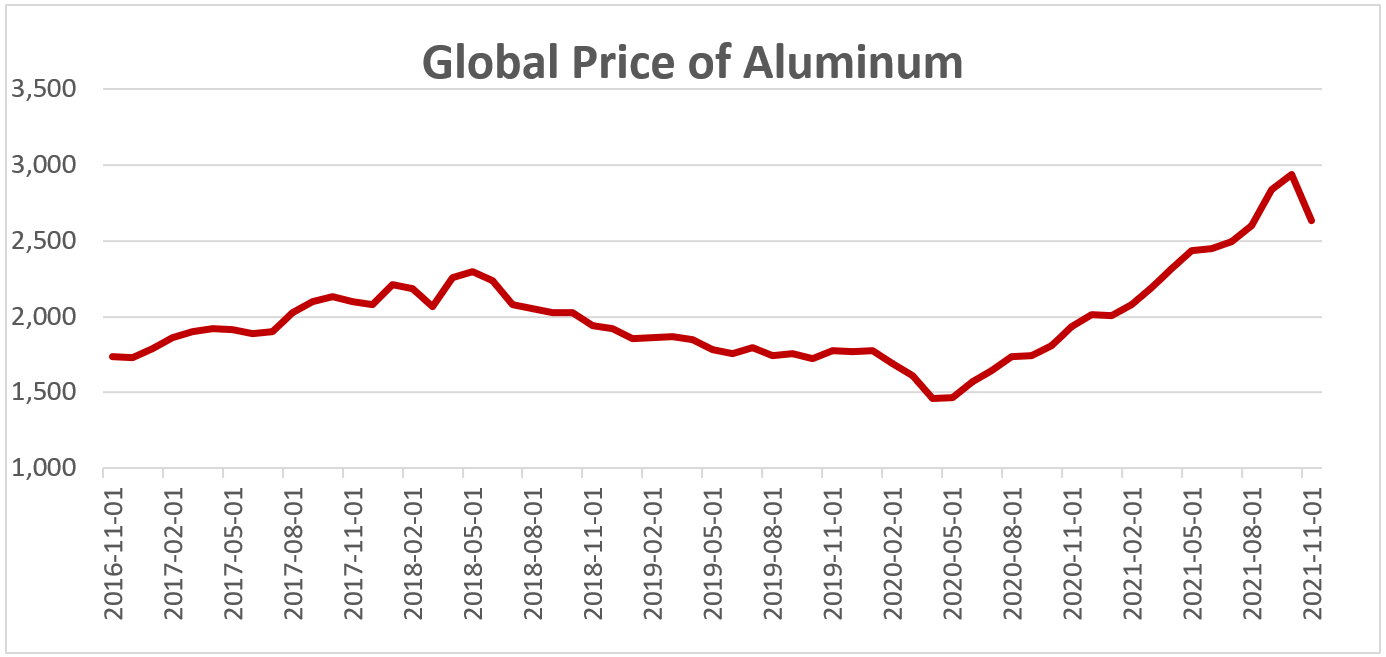

Aluminum moved from surplus to deficit in 2021 and is currently fundamentally tight in 2022. Market prices reflect this shift, with the London Metal Exchange (LME) price breaching $3,175/metric ton last October, its highest level since 2008. Regional premiums have also shown strength. We believe that the current market view of aluminum supply and demand in 2022 is still tense, but there is a possibility that demand growth could become flat later.

The EU and Midwest premiums have been reflecting market anxiety over the ongoing crisis between Russia and Ukraine. For aluminum, Russia is one of the world’s largest producers and exporters. If the flow of metal from Russia is disrupted, the LME price could easily clear $4,000/metric ton and threaten the all-time record of $4,280/ metric ton set in 1988.

Fundamentally, the market has shown a deficit of more than 1.7 million metric tons in 2021, which should be maintained through the near term. We think that the market could potentially expand to over 2.0 million metric tons in 2022 because of supply-side weakness in the first half of the year. Finally, any improvement in oceangoing shipping will help the flow of metal globally and lower premiums, since it is hard to see how seagoing logistics services could be worse than in the past year.

Below is the chart showing historical price trends for aluminum in the global market.