June 14, 2023

By Xinyao Wang

Last year, large cities like LA and SF shared an escalation rate of around 13%, while other cities saw escalation figures between 8% to 11%. After a year of historic construction cost increases worldwide, we expect the U.S. to have a moderate escalation of construction of 4.3% to 5% in 2023. In the industrialized world, the U.S. leads the pack with a predicted construction-market growth rate that will average 4% a year through 2025. Overall, the U.S. market outlook continues to be positive, and we expect the escalation to return to normal this year.

The dramatic increases in escalation over the last two years have been almost entirely due to rising materials costs. Many of the materials used in construction, like copper or lumber, can only be produced in places where it is physically present. Because of the way restrictions constantly changed early in the pandemic, along with shifting consumer preferences, materials costs changed by orders of magnitude at a time. Energy prices and global supply chain constraints emanating from the Ukraine conflict and China’s zero-COVID policy exerted upward cost pressure on construction projects.

In 2023, the overall U.S. construction market is set to contract by about 3%. However, more favorable trends are seen for non-residential construction, especially the manufacturing sector, which should see 5% growth as manufacturers move back to the U.S. Interest rate hikes from the Federal Reserve have brought on a deep housing recession in many cities. This is expected to continue even as the Fed relaxes many of its policies. Rather than a strict decline, we expect several trends to shift spending around the market. Retail volume should shift into warehouses, while offices should shift to residential and data centers. As offices in downtowns across the country remain less than half full, cities are looking at turning unoccupied spaces into affordable housing. Additionally, the just-enacted Inflation Reduction Act, which will allocate $369 billion in funds and tax incentives for green manufacturing and clean energy, will play a large part in the sector increase through the end of the decade. We expect that manufacturing sector construction will still be at a historically high level of activity in the near future.

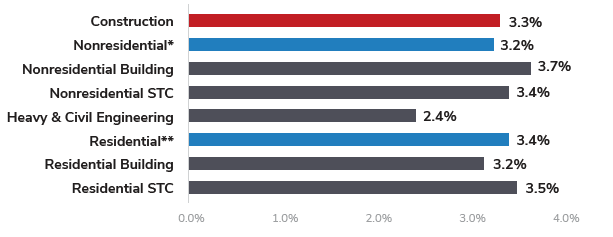

This year, while transportation costs and costs for materials such as steel, lumber, and aluminum began to stabilize, the shortage of skilled labor continues to increase labor rates, particularly in regions with robust levels of construction activity. The construction industry will need to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023 to meet the demand for labor, says the Associated Builders and Contractors (ABC). The construction industry is said to have averaged more than 390,000 job openings per month in 2022, the highest level on record, and the industry unemployment rate of 4.6% in 2022 was the second lowest on record, higher than only the 4.5% unemployment rate observed in 2019. Despite sharp increases in interest rates over the last year, the shortage of skilled construction workers will not disappear soon, which may drive the escalation higher.

In addition, trade contractors are being selective in taking on work to maintain balance with available labor. When architects are busy, contractors likely are, too. The Architecture Billing Index from the American Institute of Architects is an indicator of future nonresidential construction spending nine to 12 months down the line. Numbers above 50 on the ABI indicate an increase in billings. The ABI remained positive in 2022 until October when it took a sharp downward turn, indicating that recession fears and inflation have finally started to manifest in the industry and may translate to a drop in available construction work. Overall, we do not think there will be a recession in 2023 but it is more likely to be problematic in 2024 or 2025.

Construction Employment Growth: November 2021. v. November 2022

Source: Bureau of Labor Statistics

*Includes Nonresidential Building, Nonresidential STC, and Heavy and Civil Engineering

**Includes Residential Building and Residential STC

As the overall jobs market shows signs of weakening, the industry may be able to benefit from more people seeking work. Still, upcoming federal spending promises to keep demand for construction workers high. The long duration of many projects — especially larger infrastructure funded by the IIJA — is likely to provide sufficient opportunities for the market to maintain heightened activity levels even with more narrow margins.

The construction market is being pulled in multiple directions by several forces. Some factors impact construction companies’ budgets directly. These include the price of materials and supply chain disruptions. Others are more circuitous, but still important, such as higher lending costs leading to tighter financial conditions.

According to a survey by Associated General Contractors of America (AGC) and Sage, 73% of contractors (compared to 86% the year prior) expect to struggle with material costs as a major concern in 2023. Contractors surveyed by AGC are slightly more concerned about labor costs in 2023 than in the prior year, as 63% cited it as a main concern this year compared to 58% in last year’s survey. Firms’ continuing struggle to find workers may end up driving costs higher in this area. Beyond the immediate and direct expenses associated with labor and construction materials, construction leaders are keeping an eye on the macroeconomic picture. Nearly three-fourths of contractors are worried about the general financial impact of a potential recession or slowdown, with 73% listing this concern among their top priorities.

Some mitigation methods to bring down the construction escalation rate involve becoming more flexible. Increased material costs or delays associated with certain components could be caused by specific supply chain issues affecting particular suppliers. A report in “Construction Business Owner,” for instance, recommends that construction firms be more open to sourcing alternative construction materials and making substitutions.

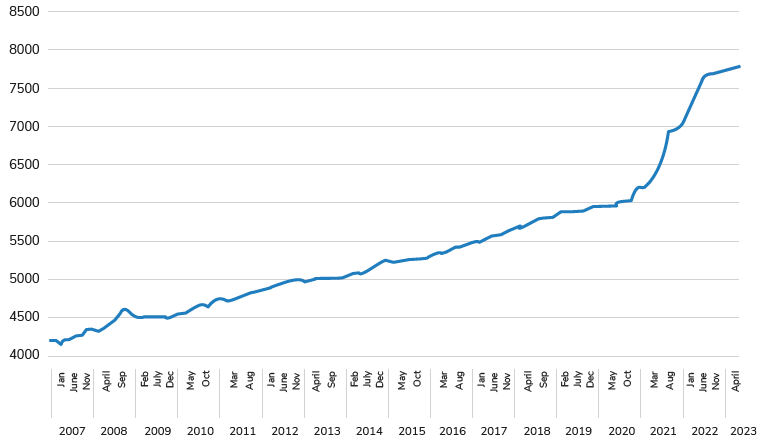

ENR Building Cost Index 2007 – 2023

Source: ENR Building Cost Index