April 22, 2022

By Xinyao Wang, Insights Team

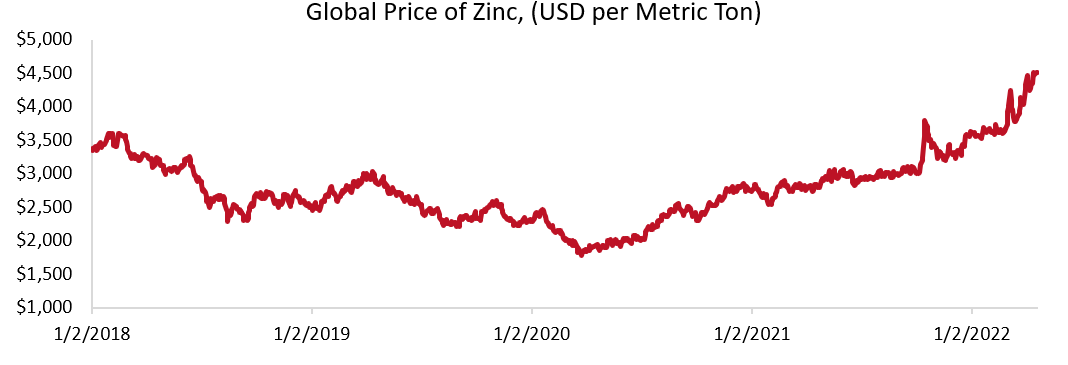

Zinc prices reached their highest levels ever recorded in the days following Russia’s invasion of Ukraine. While neither country produces a substantial amount of zinc (which is largely used in the construction industry to galvanize metals), Russia in particular is a significant supplier of oil and gas. Zinc smelting (the process of extracting zinc from ore) is an extremely energy-intensive process, and most smelters get their power from oil and coal powerplants. When the price of oil began rising in response to sanctions, zinc producers in China, Peru, and Australia raised prices in tandem to cover their costs.

The conflict in Ukraine has upended the world economy for the third time in recent years. Sanctions effectively reduced the world’s supply of crude oil by 11% overnight, leaving businesses across the world scrambling to keep the lights on. In response, producers found themselves worried about sanctions and inflation and opted to buy now rather than wait for prices to rise. This created more demand, which drove prices up even further and reduced overall supply. Russia is unlikely to rejoin the world economy for a long time – if it does at all – so these issues of supply, demand and inflated prices are likely to persist until an alternative to Russian oil and gas is found.

There are a few bright spots, however, which have the potential to reduce zinc prices by a fair margin. Sanctions have had the greatest effect on European producers, who have had to cut zinc production due to high electricity costs. As such, European consumers now must look elsewhere for zinc. This represents an incentive for smelters outside of Europe to increase production. Given the existing global mining infrastructure, this should be achievable. If the logistics situation improves even slightly – and there is good evidence that it will – it could cause prices to fall to around $3,800/metric ton by the end of the summer.

For now, it is best to wait for supply conditions to improve before making major purchases. The chart below shows historical trends for zinc in the construction industry. This data is based on current trends and is subject to change. Markets remain volatile because of COVID-19 and now the war in Ukraine, and we continue to see them change on an almost daily basis.

Source: Markets Insider